#1. Buydowns

This Playbook Series is designed to explain several mortgage programs available today as well as some hacks to help those with current mortgages pay less over time.

There are a few common buydown products that clients can take advantage of, including an Interest Rate buydown, 3-2-1 buydown and a 2-1 buydown. While the following examples reference sellers paying for the buydowns specifically, buyers or lenders can also pay for interest rate buydowns.

How it Works

A rate buydown is a way to pay for a lower interest rate by purchasing discount or mortgage points.

Value to Clients

Buydowns can be a benefit to both buyers and sellers. Sellers get a competitive advantage and buyers get to make a one-time payment to reduce their interest rate for the length of the loan.

A common misconception is that 1% = 1 point. In reality, approximately 1 point = 0.25% of the mortgage rate. Buying down the rate by 1 point costs 1% of the loan amount.

Here is how the math works on a 30-year mortgage

*Not including taxes, insurance, or private mortgage insurance (PMI). Figures are rounded to the nearest whole dollar.**Can be paid by buyer, seller or lender.

Shoot me a text @ 505-350-8184 with 'Preferred Lender' and I will send you contact information for our amazing lender!

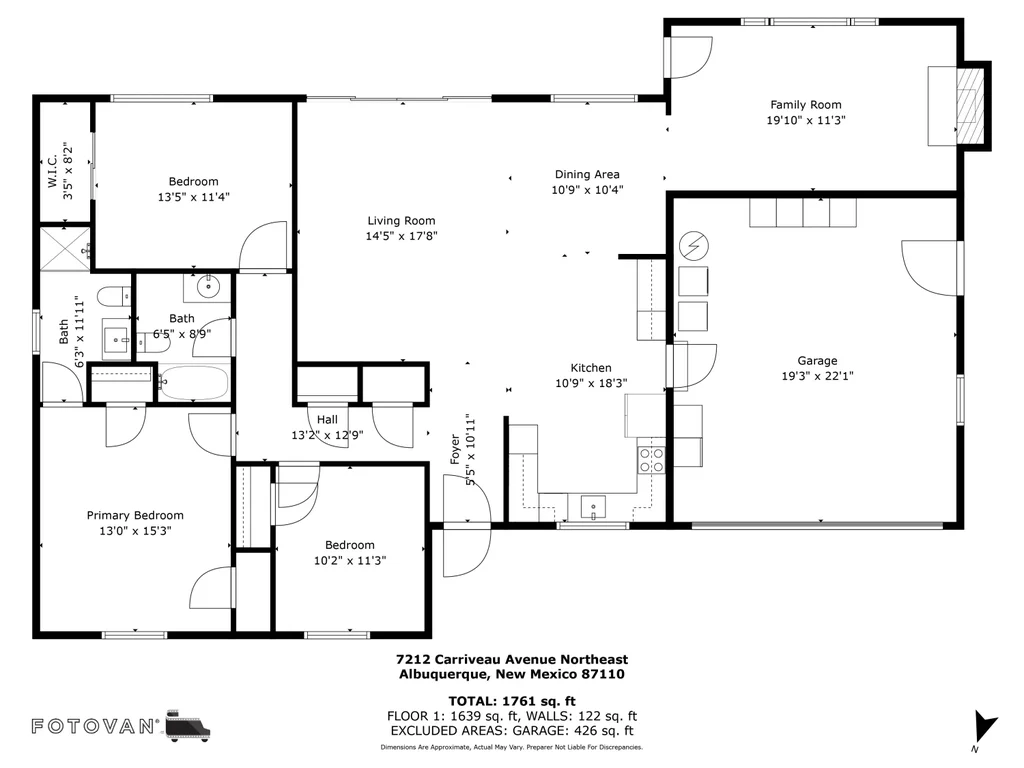

Newest Listings Albuquerque

- All Listings

- $100,000 - $200,000

- $200,000 - $300,000

- $300,000 - $400,000

- $400,000 - $500,000

- $500,000 - $600,000

- $600,000 - $700,000

- $700,000 - $800,000

- Over $1,000,000

Leave A Comment